Overview of Recent Art Auction Trends

Recent art auction trends highlight a surge in high-value sales and increased competition among buyers. Auctions recently set exceptional records, with several pieces fetching unprecedented prices.

- Record-breaking Sales: Recent auctions saw several records smashed. A Jean-Michel Basquiat piece sold for $110.5 million at Sotheby’s, and a Picasso from his “Musketeer” series went for $179.4 million at Christie’s.

- Digital Art and NFTs: Digital art has gained traction, especially NFTs (non-fungible tokens). Beeple’s digital artwork, “Everydays: The First 5000 Days,” sold as an NFT for $69.3 million at Christie’s, fostering a new era in art collecting.

- Emerging Artists: Newcomers are seeing rising demand. Works by artists like Amoako Boafo and Jadé Fadojutimi have experienced substantial appreciation, with auction prices climbing sharply.

- Global Participation: Increasing global interest is evident. Buyers from Asia, particularly China, are significantly impacting the market, often competing fiercely for high-value pieces.

- Private Sales Versus Auctions: While auction sales dominate headlines, private sales also play a crucial role. Galleries and dealers report strong private transactions, sometimes rivaling public auction results.

These trends indicate a vibrant, evolving market where traditional and digital artworks coexist, and competition drives prices to new heights. The blend of veteran and emerging artists enriches the landscape, while global participation and evolving sale mechanisms keep the market dynamic and unpredictable.

Top Record-Breaking Auctions

Art auctions have seen several remarkable sales that set new records for individual pieces and artists. These auctions highlight significant moments in the art market, showcasing both traditional masterpieces and contemporary creations.

The Most Expensive Artworks Sold

Several artworks have shattered previous records with astounding sale prices. Leonardo da Vinci’s “Salvator Mundi” sold for $450.3 million in 2017, making it the most expensive painting ever auctioned. Another notable example is Pablo Picasso’s “Les Femmes d’Alger,” which fetched $179.4 million in 2015. Jean-Michel Basquiat’s untitled 1982 painting was sold for $110.5 million in 2017, setting a record for a piece of contemporary art. Additionally, digital art has entered the scene, with Beeple’s NFT “Everydays: The First 5000 Days” sold for $69.3 million in 2021, marking a groundbreaking moment for the digital art market.

Noteworthy Auction Houses and Their Sales

Prominent auction houses play a pivotal role in these record-breaking sales. Christie’s holds the record with the sale of Leonardo da Vinci’s “Salvator Mundi.” In contrast, Sotheby’s facilitated the $110.5 million sale of Jean-Michel Basquiat’s untitled painting. Phillips has also emerged as a key player, excelling in contemporary and digital art auctions. Their sale of a David Hockney painting for $28.5 million in 2021 showcases their growing influence. Bonhams, though smaller, made headlines with the sale of a Banksy piece for $12.1 million in 2021. These auction houses continue to drive the art market, connecting high-value artworks with passionate collectors.

Factors Driving High Auction Prices

Multiple components contribute to the escalating prices seen at art auctions. These elements intertwine, fueling significant bids and record-breaking sales.

Economic Influence

Economic conditions play a pivotal role in auction outcomes. When markets are stable, affluent buyers feel more confident in investing substantial amounts in art. Wealthy individuals and institutional investors frequently diversify their portfolios, viewing art as a secure asset. According to Art Basel and UBS’s Art Market Report, the art market’s value reached $64 billion in 2019. Tax incentives and financial instruments like art-backed loans also encourage high spending.

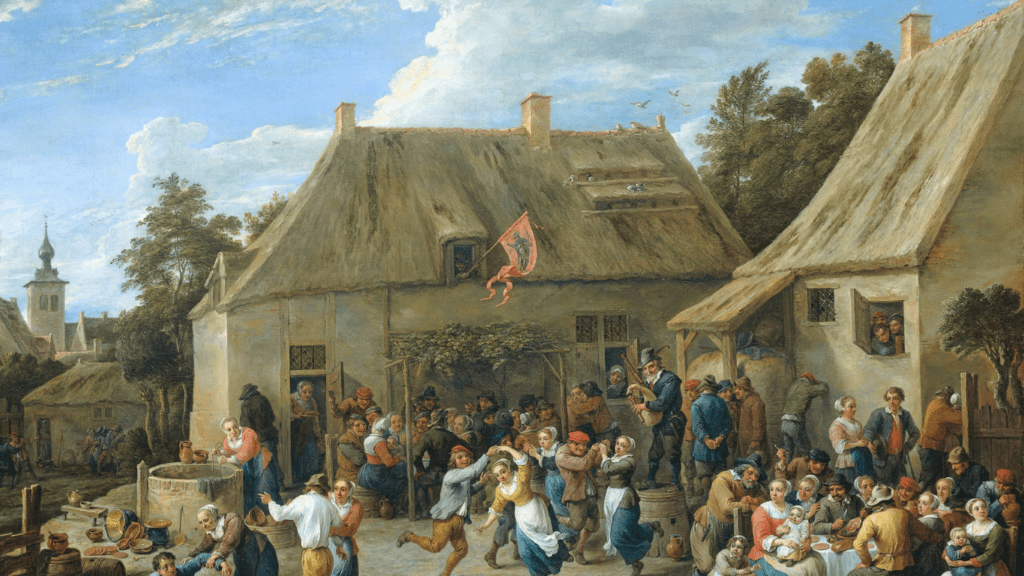

Cultural and Historical Significance

Cultural and historical significance often enhances an artwork’s value. Pieces with rich provenance or those linked to significant historical events tend to fetch higher prices. Artifacts associated with renowned cultural movements or pivotal periods in history attract enthusiastic bidders. For example, Leonardo da Vinci’s “Salvator Mundi” achieved its record price partly due to its rarity and the artist’s historical importance.

Prominent Artists and Their Impact

Works by prominent artists drive high auction prices due to their established reputation and influence. Renowned artists like Pablo Picasso, Jean-Michel Basquiat, and contemporary figures like Beeple command high prices because of their global recognition and critical acclaim. Collectors target these artists to enhance their collections’ prestige. Emerging artists like Amoako Boafo also impact the market, showing significant potential and attracting considerable attention.

Comparisons to Previous Records

Recent art auction records provide fascinating insights when compared to historical trends.

Recent Records vs. Historical Trends

Today’s auction records continue to reach unprecedented levels. Da Vinci’s “Salvator Mundi” sold for $450.3 million in 2017, surpassing the previous record for a painting sold at auction by more than double. This sale significantly outstripped the $179.4 million paid for Picasso’s “Les Femmes d’Alger (Version O)” in 2015. Similarly, Basquiat’s “Untitled” fetched $110.5 million in 2017, demonstrating a sharp increase from his earlier record of $57.3 million set in 2016. These records emphasize the growing appreciation and value assigned to art over time.

Analyzing the Growth in Art Market Value

The art market’s value has seen notable growth, driven by economic stability, cultural shifts, and the rise of digital art. According to the Art Basel and UBS Global Art Market Report 2020, the global art market was valued at $64.1 billion in 2019. Factors such as high liquidity in financial markets and the surge of high-net-worth individuals investing in art have propelled this growth. Digital art, exemplified by Beeple’s $69 million NFT sale, has expanded market dynamics. This growth trajectory indicates that both established and emerging art forms are increasingly seen as valuable and secure investments.

Implications for Collectors and Investors

Art auction records recently set new benchmarks, significantly impacting both collectors and investors.

Investment Potential

High auction prices indicate robust investment opportunities in the art market. Works by Leonardo da Vinci, Picasso, and Basquiat consistently fetch record sums, suggesting strong demand for renowned artists. Digital art, exemplified by Beeple’s NFT sale, introduces new investment avenues. Art Basel and UBS reported the art market’s value increased, attracting more investors due to economic stability and cultural trends favoring art as an asset.

Risks and Considerations

- While the art market offers lucrative investment prospects, several risks must be evaluated.

- Market volatility can affect art prices, influenced by economic shifts and cultural trends.

- Authenticity issues and provenance concerns necessitate thorough vetting to avoid fraud.

- The rise of digital art brings its unique challenges, such as rapid technological changes and the need to understand blockchain mechanisms.

- Despite these risks, well-informed investments grounded in comprehensive research can yield substantial returns for collectors and investors.